Comprehensive Overview of the Revolutionary Fiscal Framework

The 2026 Zimbabwe National Budget represents a paradigm shift in taxation philosophy, introducing sophisticated compliance mechanisms and closing critical tax loopholes. This comprehensive guide provides businesses, investors, and tax professionals with actionable insights into the fiscal year’s most significant changes.

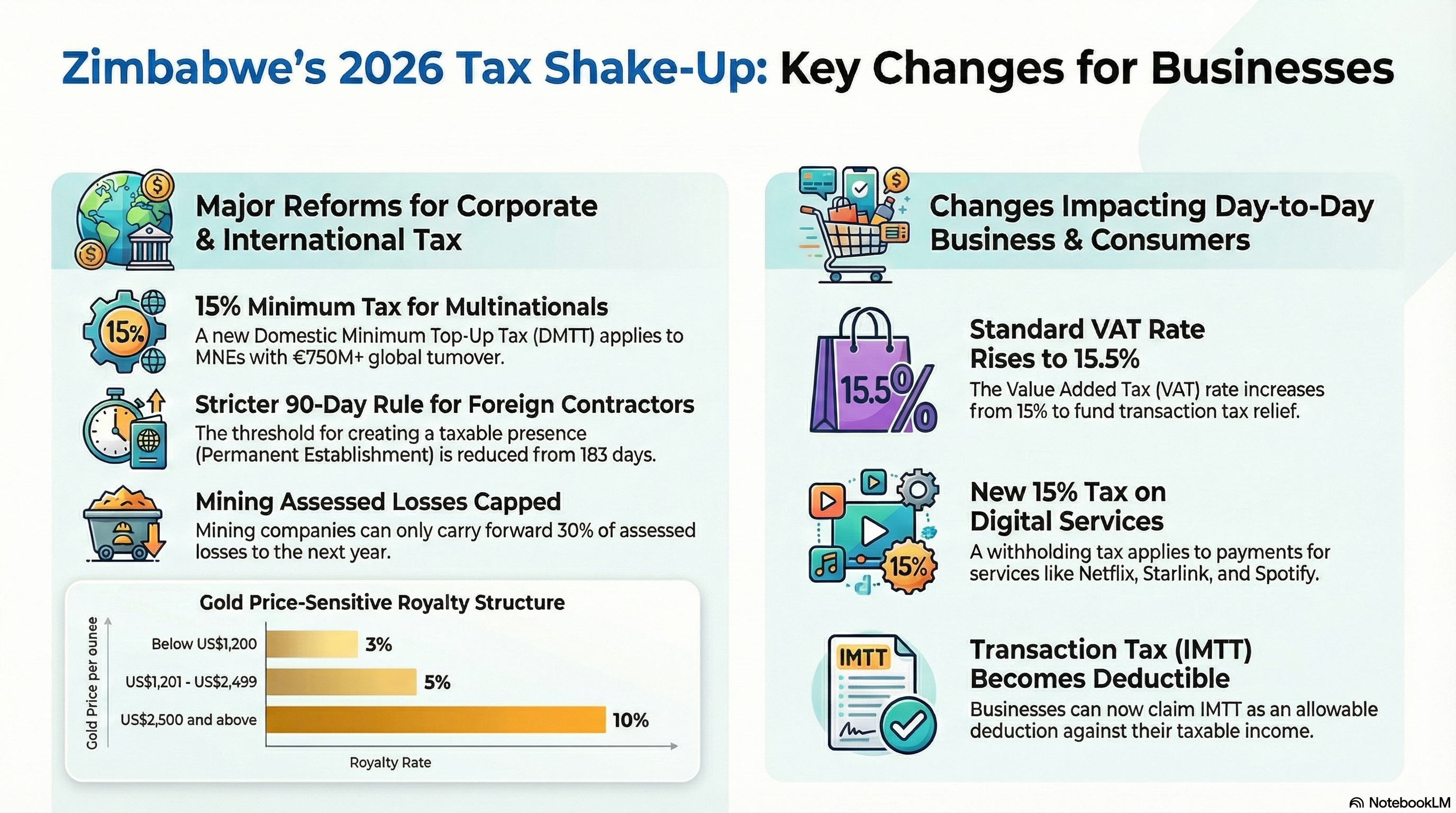

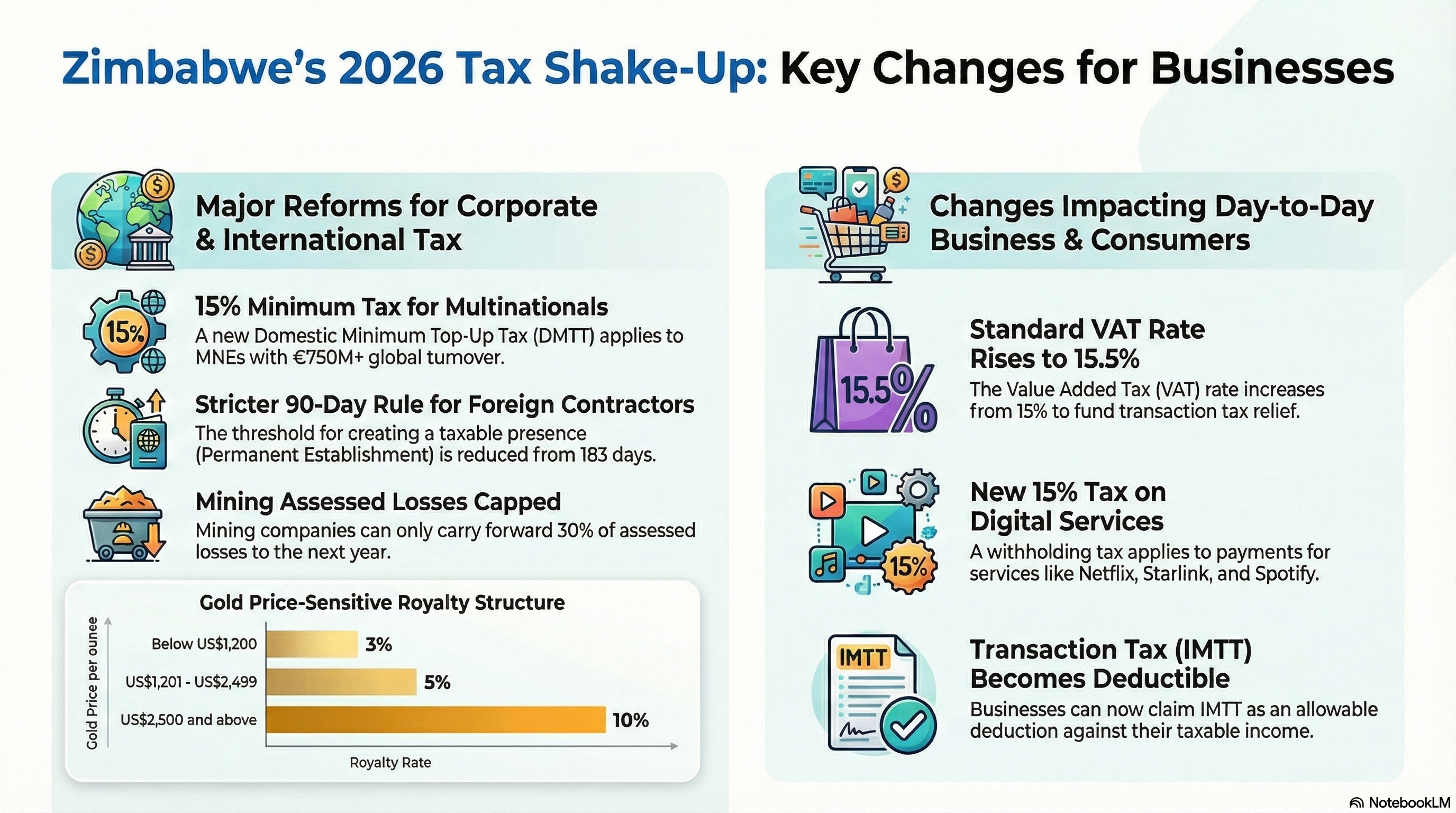

Key Takeaways:

- VAT increases from 15% to 15.5% effective January 1, 2026

- New Domestic Minimum Top-Up Tax (DMTT) ensures 15% minimum effective tax rate for large MNEs

- IMTT reduced to 1.5% for ZiG currency transactions, remains 2% for USD

- Permanent Establishment threshold reduced from 183 to 90 days

- Mining companies restricted to carrying forward only 30% of assessed losses

- Digital Services Withholding Tax of 15% on foreign platforms

- Technology-driven enforcement through Tax and Revenue Management System (TaRMS)

Introduction: Understanding the 2026 Fiscal Pivot

Zimbabwe’s 2026 National Budget, themed “Enhancing Drivers of Economic Growth and Transformation Towards Vision 2030,” introduces a comprehensive “Quid Pro Quo” fiscal strategy. This approach balances tax relief in production sectors with increases in consumption taxes to maintain revenue neutrality while navigating global economic headwinds.

With global growth projected to slow to 3.1% in 2026 and Zimbabwe’s heavy reliance on commodity exports like gold and lithium, the Treasury has designed this budget to maximize Domestic Resource Mobilization (DRM) without resorting to unsustainable borrowing. For the first time, technology takes center stage in tax administration, with the TaRMS platform enabling real-time monitoring of transactions and automatic denial of non-compliant input tax claims.

The Macro-Fiscal Strategy: Quid Pro Quo Explained

The defining characteristic of the 2026 budget is its explicit “Quid Pro Quo” revenue management approach. This strategy implements a structural trade-off: reducing the distortionary Intermediated Money Transfer Tax (IMTT) while compensating through increased Value Added Tax (VAT).

Why This Matters for Business

The private sector has long criticized IMTT as a cascading tax that inflates business costs at every transaction stage. By reducing IMTT for local currency (ZiG) transactions from 2% to 1.5%, the government alleviates pressure on production chains. However, the VAT increase to 15.5% shifts the burden to final consumers, aligning with orthodox economic principles that favor consumption taxes.

Key Insight: This pivot from transaction taxes to consumption taxes represents a fundamental shift in Zimbabwe’s tax philosophy—one that prioritizes competitiveness of domestic goods while securing revenue stability.

Corporate Income Tax: The DMTT Revolution

While the standard Corporate Income Tax (CIT) rate remains at 25% for the 2026 tax year, multinational enterprises (MNEs) face significantly higher effective rates due to base-broadening measures.

Domestic Minimum Top-Up Tax (DMTT): A Game Changer

The DMTT aligns Zimbabwe with the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS). This sophisticated mechanism targets MNEs with consolidated annual turnover exceeding €750 million, ensuring they pay a minimum 15% effective tax rate (ETR) on Zimbabwean profits.

How DMTT Works:

- Calculates effective tax rate on Zimbabwe-sourced profits

- If ETR falls below 15% due to incentives or holidays, DMTT “tops up” to 15%

- Fundamentally alters value of tax incentives like 5-year SEZ holidays

- Defensive measure: if Zimbabwe doesn’t collect, home jurisdiction will

Example: A mining MNE enjoying a 0% tax holiday in a Special Economic Zone will now face a 15% DMTT payment, effectively eliminating the benefit of the incentive for qualifying large companies.

Permanent Establishment: 90-Day Threshold

Foreign contractors operating on a project basis face significantly tighter rules. The Permanent Establishment (PE) threshold has been reduced from 183 days to 90 days for construction, building, or installation projects within any 12-month period.

Impact on Construction & Engineering Sectors:

- Projects lasting 3+ months now create taxable presence

- Immediate CIT registration required

- Full PAYE and VAT compliance obligations triggered

- Previous 4-5 month structuring loopholes closed

Mining Sector Assessed Losses: The 30% Cap

Effective January 1, 2026, mining companies with assessed losses as of December 31, 2025, or in subsequent years can only carry forward 30% of such losses to the next year of assessment. This creates a quasi-minimum tax for the sector.

Previously, capital-intensive mining operations could offset substantial losses over multiple years, effectively paying zero CIT. The new restriction forces mines to pay tax sooner, smoothing government revenue and preventing extended periods of zero contributions from profitable operations.

Value Added Tax Reform: The 15.5% Reality

The increase in the standard VAT rate from 15% to 15.5% carries widespread inflationary implications and demands immediate systems compliance across all businesses.

Implementation and Compliance Requirements

Retailers and service providers must ensure fiscal devices, Point of Sale (POS) systems, and ERP software calculate VAT at 15.5% precisely at midnight on December 31, 2025. ZIMRA compliance audits in 2026 will heavily focus on correct rate application during the transition period.

Critical Action Items for Businesses:

- Update all fiscal devices before December 31, 2025

- Verify POS systems calculate 15.5% accurately

- Update ERP software and accounting platforms

- Train staff on new rate application

- Review pricing strategies to absorb or pass on 0.5% increase

Currency Mandates for Imported Services

To capture foreign currency liquidity, VAT on imported services must now be paid in United States Dollars or equivalent foreign currency. This applies to management fees, software licenses, and technical services from non-residents.

The previous loophole allowing local currency remittance at official exchange rates—creating arbitrage opportunities—has been strictly closed. Specific penalties now apply for failure to remit in the specified currency.

Export Taxes and Beneficiation Policy

VAT is being leveraged as an industrial policy tool to enforce mineral beneficiation. Tiered export taxes effectively punish raw material exports while incentivizing domestic processing.

| Product | Export Tax Rate | Policy Intent |

|---|---|---|

| Raw Lithium Ore | 10% | Heavily discourage raw exports |

| Lithium Concentrate | 5% | Moderate processing incentive |

| Lithium Sulphate (Processed) | 0% (Zero-rated) | Full domestic processing reward |

| Raw/Lightly Processed Chrome | 5% | Encourage beneficiation |

These taxes, payable in USD, make raw resource exports economically punitive, forcing mining companies to invest in domestic processing infrastructure.

Digital Economy Taxation: Closing the Digital Gap

Digital Services Withholding Tax

Recognizing the digital economy as a source of base erosion, a 15% Digital Services Withholding Tax now applies to payments made to foreign digital platforms including Netflix, Spotify, Amazon Web Services, and Starlink.

Unlike previous unsuccessful attempts to register these entities for VAT, the new model places the collection burden on financial intermediaries. Banks and mobile money operators are appointed as withholding agents, required to deduct 15% from payments and remit to ZIMRA. This cost will likely be passed directly to consumers.

Affected Services:

- Streaming platforms (Netflix, Spotify, Disney+)

- Cloud services (AWS, Microsoft Azure, Google Cloud)

- Satellite internet (Starlink)

- Software subscriptions (Adobe, Microsoft 365)

- Digital advertising platforms (Google Ads, Facebook Ads)

Non-Resident Interest Withholding Tax

The government has reintroduced Non-Residents Tax on Interest at 15%, targeting intra-group financing structures used by MNEs to shift profits to low-tax jurisdictions. This establishes a floor for the cost of foreign debt capital and reduces incentives for artificial debt loading.

IMTT Overhaul: Promoting Local Currency Usage

The Intermediated Money Transfer Tax undergoes significant structural changes designed to incentivize Zimbabwe Gold (ZiG) currency adoption while maintaining revenue from USD transactions.

IMTT Rate Changes

| Transaction Type | 2025 Rate | 2026 Rate |

|---|---|---|

| ZiG (Local Currency) | 2.0% | 1.5% ✅ |

| USD & Foreign Currency | 2.0% | 2.0% |

| High-Value (>US$500,000) | No Cap | Capped at US$10,150 |

Game-Changing Development: IMTT is now an allowable deduction for Corporate Income Tax purposes. Previously treated as a “final tax” and added back to taxable income, businesses can now reduce their CIT liability by the IMTT paid. This significantly benefits high-volume retailers and distributors.

Additionally, microfinance institutions are now classified as “financial institutions,” ensuring transactions through micro-lenders are subject to IMTT.

Real Estate and Informal Sector: Closing Loopholes

Special Capital Gains Tax on Share Transfers

A major tax avoidance structure has been eliminated. Effective January 1, 2026, a 20% Special Capital Gains Tax applies to transfers of shares in entities where value is derived principally from immovable property.

Previously, property owners sold company shares rather than the actual building to avoid transfer duties. This measure levels the playing field, requiring payment in foreign currency within 30 days of transaction.

Critical Change: This closes one of the most widely-exploited tax planning structures in Zimbabwean real estate, bringing share-based property transfers in line with direct property sales.

Presumptive Taxpayer Rental Tax: Deputizing Landlords

In an innovative move to formalize the shadow economy, landlords are now required to withhold 10% of rentals paid by tenants liable for Presumptive Tax. This effectively deputizes landlords as tax inspectors.

How It Works:

- Landlord must verify tenant has valid Tax Clearance Certificate

- If no certificate (tenant on presumptive tax), withhold 10% of rent

- Remit withheld amount to ZIMRA

- Failure to verify/withhold makes landlord personally liable

This creates a “self-policing” mechanism where landlords must enforce tenant tax compliance to protect themselves from liability.

Migration to Self-Assessment

Certain sectors previously covered by flat presumptive taxes are graduating to formal tax regimes. Operators of public service buses (capacity >25 passengers), haulage trucks, and commercial water vessels must now:

- Register for Income Tax

- Maintain proper books of accounts

- File returns based on actual profits

- Comply with full VAT and PAYE obligations

ZIMRA has partnered with local authorities who will retain 10% of collected funds, creating enforcement incentives at bus terminals and markets.

Individual Taxation: Dual Currency PAYE System

With ZiG currency firmly established, the Pay As You Earn (PAYE) system now utilizes separate tax tables for each currency. Employers must segregate income by currency and apply the relevant schedule.

ZiG Tax Brackets (Annual)

| Income Range (ZiG) | Tax Rate |

|---|---|

| ZiG 0 - 33,600 | 0% (Tax-Free) ✅ |

| ZiG 33,601 - 100,800 | 20% |

| ZiG 100,801 - 1,008,000 | 25% |

| Above ZiG 1,008,000 | 40% |

USD Tax Brackets (Annual)

| Income Range (USD) | Tax Rate |

|---|---|

| US$ 0 - 1,200 | 0% (Tax-Free) ✅ |

| US$ 1,201 - 3,600 | 20% |

| US$ 3,601 - 36,000 | 25% |

| Above US$ 36,000 | 40% |

Cash Withdrawal Levy: To discourage cash usage, a tiered levy applies. For individuals, withdrawals between US$501-1,000 attract 2%, rising to 3% for amounts over US$1,000.

Technology-Driven Administration: The TaRMS Revolution

The 2026 budget places technology at the heart of tax administration. The Tax and Revenue Management System (TaRMS) represents a fundamental shift from self-reporting to real-time automated verification.

TaRMS and Automated Input Tax Verification

From January 2026, TaRMS automatically populates a company’s VAT Input Tax schedule based on data from suppliers’ fiscal devices. This introduces critical compliance risks:

Critical Risk:

If a supplier lacks a compliant fiscal device interfaced with the Fiscalisation Data Management System (FDMS), their invoice will NOT appear in the purchaser’s TaRMS account, and the input tax claim will be automatically denied.

Required Action for All Businesses:

- Conduct “Fiscal Device Health Checks” on entire supply chain

- Verify all major suppliers have ZIMRA-approved fiscal devices

- Ensure devices are properly interfaced with FDMS

- Consider alternative suppliers if non-compliant

- Implement ongoing monitoring protocols

Strict Deadlines: SI 81 of 2025

Statutory Instrument 81 of 2025 separates filing and payment deadlines to allow ZIMRA time for verification and analysis. For Income Tax Provisional Returns (QPDs):

- Returns due: 20th of quarter-end month (e.g., March 20)

- Payments due: 25th of quarter-end month (5 days later)

This separation must be strictly observed. Late filing now triggers separate penalties from late payment, and both will be automatically calculated by TaRMS.

Strategic Implications for Business Leaders

The 2026 Zimbabwe Tax Guide reveals a Treasury determined to close the tax gap through technology, third-party enforcement, and strategic base-broadening. The era of informal economic activity and tax arbitrage is ending.

Immediate Action Items:

1. Systems and Technology Upgrades

- Update all fiscal devices for 15.5% VAT rate

- Verify POS and ERP system compatibility with TaRMS

- Implement dual-currency payroll systems

- Conduct supply chain fiscal device audits

2. Treasury and Liquidity Management

- Maintain adequate USD liquidity for mandatory foreign currency taxes

- Budget for increased effective tax rates (DMTT, PE expansion)

- Review transfer pricing policies for MNEs

- Plan for IMTT deductibility benefits

3. Compliance and Risk Management

- Implement supplier fiscal device verification protocols

- Train staff on separated filing/payment deadlines

- Review real estate holding structures (Special CGT impact)

- For landlords: implement tenant tax verification procedures

- Mining companies: reassess loss carryforward strategies

4. Sector-Specific Considerations

Foreign Contractors:

- Restructure project timelines considering 90-day PE threshold

- Prepare for immediate CIT/VAT/PAYE registration requirements

Mining Companies:

- Evaluate beneficiation investments (zero-rating incentive)

- Model cash flow impact of 30% loss restriction

Digital Service Providers:

- Review international subscription costs (15% WHT impact)

- Consider price adjustments to absorb withholding tax

Conclusion: Navigating the New Fiscal Reality

The 2026 Zimbabwe National Budget is not merely a collection of tax changes—it represents a fundamental transformation of the relationship between the state and taxpayers. Through technology, third-party enforcement mechanisms, and strategic alignment with global standards like the OECD BEPS framework, Zimbabwe is dismantling the structures that have allowed significant economic activity to occur outside the tax net.

For businesses, the message is clear: proactive compliance is no longer optional but essential. The integration of TaRMS with fiscal devices creates a real-time neural network where non-compliance by any party in a supply chain can instantly trigger consequences downstream. Similarly, the deputization of landlords, banks, and mobile money operators as tax collectors extends ZIMRA’s reach into previously ungovernable spaces.

The successful navigation of 2026 will require businesses to invest in systems, maintain strict USD liquidity discipline, and conduct comprehensive supply chain audits. Those who treat these changes as mere administrative adjustments risk facing automatic penalties, denied input tax credits, and cashflow crises.

Final Thought: By understanding the strategic intent behind each measure and aligning operational practices accordingly, businesses can not only achieve compliance but position themselves competitively in Zimbabwe’s evolving fiscal landscape.

The TaRMS Analogy: A Central Nervous System

To understand the magnitude of administrative changes, consider TaRMS as the “central nervous system” of the Zimbabwean economy. In previous years, ZIMRA operated like a doctor relying on patient self-reporting (manual returns) to diagnose economic health.

In 2026, through the integration of fiscal devices and FDMS, TaRMS acts like a real-time neural network. It “feels” every transaction the moment it happens. If a supplier (a nerve ending) fails to transmit a signal (a fiscal invoice), the brain (ZIMRA) immediately knows, and the body (the purchasing company) is denied the oxygen (input tax credit) it needs to function efficiently.

This interconnectedness means tax compliance is no longer just about your own books—it’s about the health of your entire business ecosystem. A single non-compliant supplier can trigger denied credits, audit flags, and compliance costs that ripple through your operations.