Introduction

For businesses in Zimbabwe, choosing the right accounting software is a critical decision. QuickBooks is a widely-used accounting platform popular with small and medium enterprises (SMEs) globally. However, its suitability for Zimbabwean businesses depends on factors such as currency handling, local tax compliance, and business complexity.

This guide provides a detailed review of QuickBooks for Zimbabwean companies, highlighting strengths, limitations, and practical considerations to help you make an informed choice.

What is QuickBooks

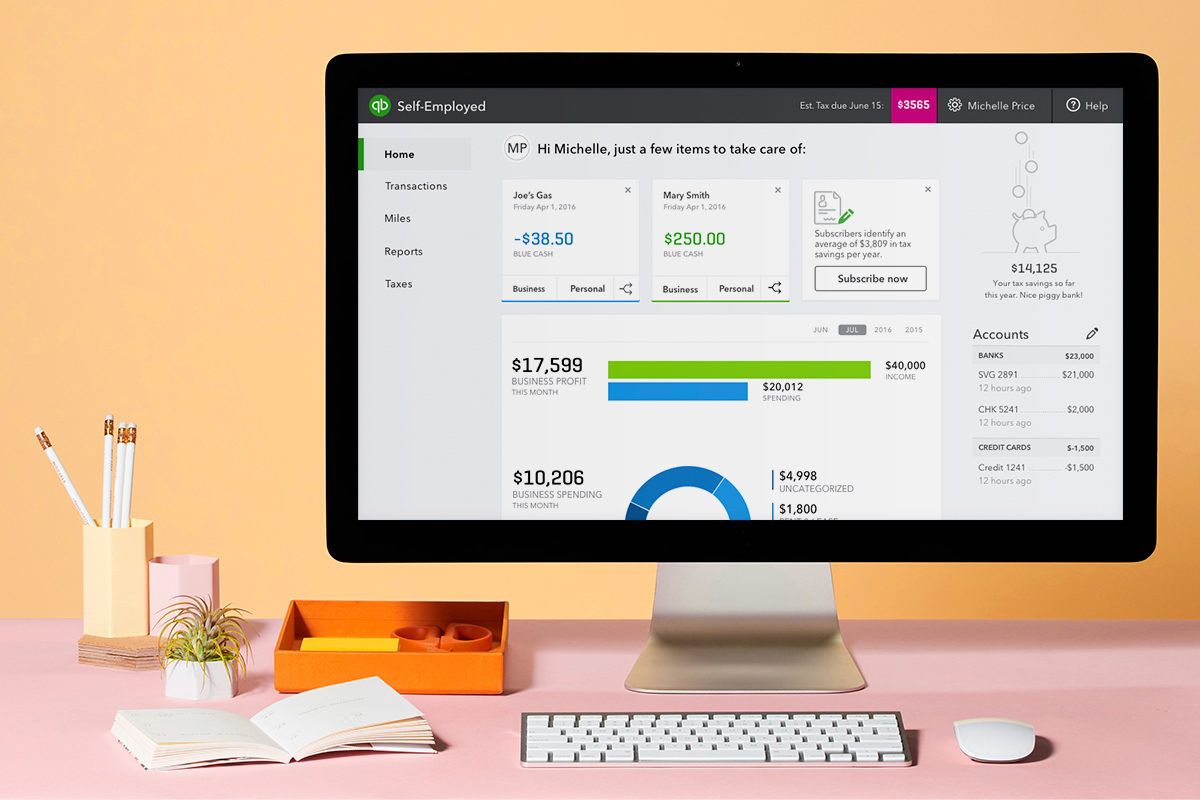

QuickBooks, developed by Intuit, is a suite of accounting software available in desktop and cloud versions. It offers features such as:

- Invoicing and billing

- Expense tracking

- Bank reconciliation

- Multi-currency support (in some editions)

- Financial reporting

- Payroll management (with limitations in some regions)

The software is widely recognized by accountants, making it easier to find trained professionals to manage or support your books.

Strengths for Zimbabwean Businesses

1. Familiarity and Ease of Use

Many accountants and bookkeepers in Zimbabwe are already familiar with QuickBooks, reducing training time and making onboarding easier.

2. Core Accounting Functionality

QuickBooks efficiently handles day-to-day accounting tasks such as recording sales, purchases, expenses, and generating financial reports.

3. Offline Capabilities

The desktop version allows offline operation, which is useful in areas with unreliable internet or frequent power outages.

4. Multi-Currency Support

Some versions allow transactions in multiple currencies, which is beneficial if your business deals in USD and ZWL.

Limitations for Zimbabwean Businesses

1. Local Currency and Tax Compliance

QuickBooks Online does not fully support the Zimbabwean Dollar (ZWL) as a home currency. Businesses often default to USD for accounting purposes, which may not align with daily local transactions.

Additionally, QuickBooks does not natively integrate ZIMRA-specific requirements, such as VAT, PAYE, and NSSA reporting. Businesses may need manual workarounds or third-party add-ons to meet compliance obligations.

2. Advanced Business Features

QuickBooks may be limited for companies with complex operations, such as multi-branch setups, manufacturing, or inventory-heavy businesses. It is best suited for SMEs with simpler accounting needs.

3. Support and Customization

While local resellers provide some support, certain features like local tax compliance and currency adaptation may require customization. Businesses should plan for potential additional costs for software configuration and support.

Key Questions for Businesses

Before choosing QuickBooks, consider:

- Which currency do you primarily transact in—USD, ZWL, or both?

- Does your business require built-in VAT, PAYE, or other ZIMRA compliance features?

- How complex are your operations—single location or multiple branches, service-based or manufacturing?

- How reliable is your internet and electricity supply?

Verdict: Is QuickBooks Right for Your Business?

For small to medium Zimbabwean businesses with relatively simple accounting needs, QuickBooks is a suitable choice. It offers ease of use, reliable accounting features, and familiar software for accountants.

However, if your business operates mainly in ZWL, requires full local tax compliance, or has complex operations, QuickBooks may present challenges. In these cases, businesses might consider local accounting solutions or customized add-ons to address regulatory and currency requirements.

Practical Tips for Using QuickBooks in Zimbabwe

- Consider the desktop version for offline use in areas with unreliable internet.

- Maintain backup copies of all financial data.

- Engage a local QuickBooks-trained accountant for guidance and support.

- Prepare for potential manual adjustments for ZIMRA compliance.

- Evaluate future growth and ensure QuickBooks can scale with your business needs.

Conclusion

QuickBooks can be an effective accounting solution for Zimbabwean SMEs if your business deals mainly in USD or has relatively simple accounting needs.

It is user-friendly, widely supported, and suitable for basic financial management, but local currency handling and tax compliance limitations should be carefully considered. Businesses with more complex requirements may need additional customization or alternative local solutions.